Martingale is profitable if you trade the right way. Forex is not just gambling with mathematical expectation of 50%: in the currency market, the odds of winning are higher. Even if your strategy is not perfect.

We’ll have a look at 4 martingale boosters:

- understanding the logic of Forex;

- controlling emotions;

- reducing trading risk;

- and increasing profit.

If you are in the red, or if your deposit has not changed for years, that’s okay. Compare your trade with the option we set out below, and, if some components are missing, update your system.

Step 1. Trend Trading

Major money is earned by trend trading. Have a look at a BGP/AUD chart:

After the start, the trend slackens slowly, as the price is driven by traders emotional inertia. Please see how tailed candlesticks point at entering before a new down-wave.

The predictable trend, zones and candlesticks are the “Money” key for a patient trader.

Sometimes it happens that a trend did not get into high gear, and your trade went into the red. That’s okay: the trend will continue and you’ll enter again.

In your system, martingale is aggressive asset management. So make up your check-list for entering the market.

To start with, a simple list of 3 items will do. Just make sure you stick to it:

- price in a trend;

- candlestick with shades;

- candlestick in the demand/supply zone.

Now let’s take the best from Forex: we’ll show how to turn the profit to your favor. It is relevant, if currently your losing trades exceed your winning trades

Step 2. Making Decent Deals

Here’s the situation:

- you had 10 winning trades,

- and 15 losing trades.

Do you think, you are out of pocket?

Only according to roulette rules, where we make a bet and are expecting a fixed outcome, such as:

- we bet $1, then we lost $1;

- we bet $2, then we won $2.

But at Forex, it is for a trader to decide how much to earn and how much to lose in a trade.

Systems are made up by traders in such a way that their earnings exceed their loss.

Risk to profit ratio must always be above 1.

Manifestation of this idea is at the chart below

We’ve used Hint 1:

- we entered following the trend at a tailed-bar candlestick zone;

- stop loss was set behind the shadows, while take profit – at the nearest peak.

Suppose, we risked $10. The profit will make $20: if we win, the earning will exceed the loss. So, the risk to profit ratio in this deal is 1 to 2.

The rule is: don’t enter, if the risk/profit ratio is below 1.5. This way you’ll afford losing more often while still being in the money.

Step 3. Win Rate 40%+

Trend trading along with risk/profit exceeding 1 will result in:

- structural system;

- profit that covers losses.

From now on, we can win in 40% of the deals and be in the black.

Strengths and advantages of Forex resulted in reduced win rate requirements: we’ve decreased the minimum win rate.

Trade is taken easier now. Trading is not the place for emotions: martingale can not be used unless your mind is calmed down.

Step 4. Reduce Martingale Factor

We have a profit-making system; why double when losing. We have reached some advantages as compared to other traders:

- we are in the money more often;

- we are risking less than we are earning;

- and we have emotions under control.

Profit exceeding risk: 1 winning trade may recover 2 losing trades. Why double after loss?

Losing 5 times in a row is a normal thing at Forex:

- you risked $50, and your forecast did not prove true;

- you then bet $100 and lose again;

- your next bet is $200, then $400 and $800.

Every new doubling the bet makes you doubt event more, bite your nails and sweat: what if the next deal doesn’t work out? What is the system failed?

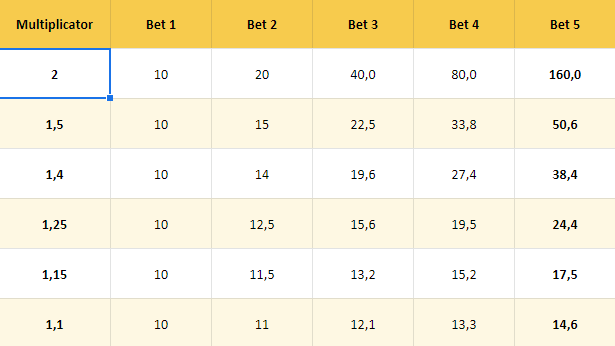

There’s too much of a risk you are carrying. But the load of pressure can be mitigated: just reduce the multiplying factor. This will bring you some emotional relief:

You are anyway winning more in this trade than you are losing.

Why don’t you increase your bet just half as much again:

- so, you are betting $100 in the first trade;

- then just $150 in the second trade;

- and $300 in the third trade. Still too much?

Then reduce the factor even more: make it 1.4, 1.25 or 1.15:

Your advantage at Forex is: trends, zones and money-management. Martingale will just slightly facilitate your profit making.

But that’s not all of it yet. The risk can be further reduced:

Step 5. Save for a Larger Deposit

Business needs money, and trading is not an exception.

No matter how you reduce your martingale factor, the trade risk is still larger than the conservative risk. To withstand the drawdowns, you need some solid deposit.

- beginners are recommended to save $500 and trade with a 0.01-0.05 lot.

- advanced traders are recommended to have $2000 accumulated at their account and an initial lot of 0.05-0.2.

Tell me honestly: do you need martingale?

We have strengthened the trade as complemented with martingale. If you follow our hints, you will enjoy effective and emotionless trading, and hence – smart betting.

There’s only one question left: do you need martingale?

Martingale is a type of money-management. It’s neither a strategy, nor a system.

It might be better just to prioritize a trade system:

- go ahead and work through 1 candlestick setup;

- bring win rate to 60%;

- use various time frames for trading.

With a win rate over 60% you may enjoy conservative trading: your deposit will grow gradually. Why accelerate, if your entire account is at stake?

And, instead of inviting you to leave your comments, let me give you one more piece of advice:

Manage your trades: look for candles that support the forecast. Make 2 to 3 enters, split your orders, reduce your Stop Loss and increase your Take Profit.

Good luck with trading!