How do professional traders spot great trading opportunities in the financial market almost every day? Which key traits separate experienced traders from beginners? What steps to take to become a successful professional trader? Read on to find out.

Article content

Differences between professional traders and beginners

Any professional trader was once a beginner and asked all types of questions starting from “Can you make money trading?” and “How much can you earn trading Forex?” to “How to make money in a particular situation?”. While looking for answers, the novice trader took a series of actions, gradually growing to the next level and becoming a professional.

Many seasoned traders highlight three key differences between them and those who are just taking their first steps in trading. These are:

- Investing in your self-education. In the past decades, traders have accumulated immense experience in dealing with financial markets. Before developing your own unique approach and strategies, we suggest that you tap into the knowledge and valuable experience of professional traders. Maybe, the ready-made strategies will work for you, and you won’t need to invent anything yourself.

- Practice over theory. Experience comes with practice. Even if you have read dozens of books on how to drive a car, you are unlikely to become a skillful driver and feel confident behind the wheel right away. Driving is a skill that requires practice. So as trading. Any professional trader will tell you to set up a risk-free demo account with virtual balance and put your theoretical knowledge into practice.

- Trading is exciting. Enjoy the process when analyzing, placing pending orders, taking profits, and developing new strategies. In this case, you will not get tired of both the learning process and trading itself.

These three simple ideas may be on the surface, but they can fundamentally change your process of becoming a professional trader: they will make it more effective and exciting.

Stages of a trader’s development

Each trader moves through a certain learning curve to gain experience and competence. This process is not bound by time but almost always includes the following key stages.

Stage 1. Unconscious incompetence

At this stage, a trader gets acquainted with financial markets and trading. At this point, a novice trader has only found out about this field of activity and doesn’t possess the necessary amount of knowledge and competencies to perform market analysis and make a stable income from trading. As long as traders try to anticipate the change in the selected asset by guessing, using merely their intuition, they are trading unconsciously and often inefficiently.

Stage 2. Conscious incompetence

The trader begins to study materials on professional trading and financial markets, looks into the opinions of specialists and recognized experts, and begins to test various trading ideas.

There are a lot of trading approaches and strategies, and each of them has the right to exist:

- trend trading;

- position trading using fundamental analysis;

- swing trading;

- focusing on one particular financial instrument (for example, Brent and WTI oil);

- and others.

This stage is characterized by an active increase in “trader’s IQ” but is still accompanied by a lack of stable financial results.

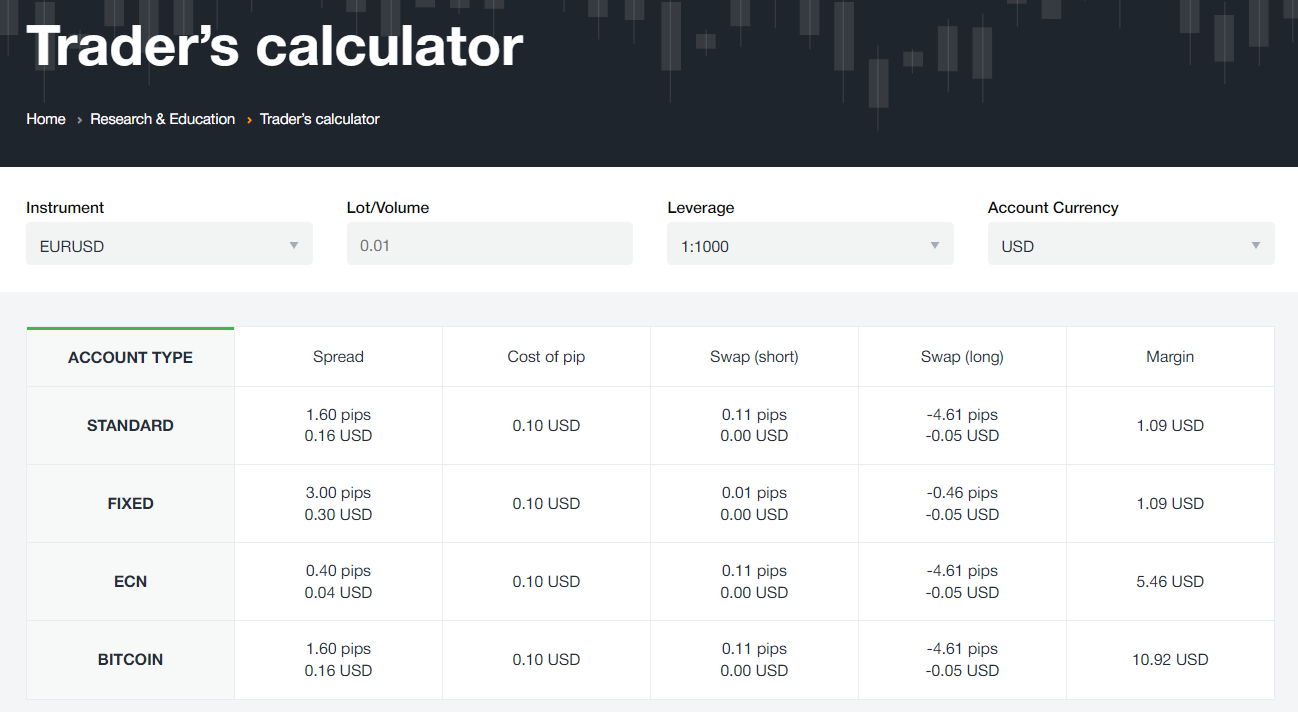

The AMarkets Trader’s Calculator is a convenient tool that allows traders to calculate margin requirements, the pip value, swap size, and spread for the selected asset.

An example of using the “Trader’s Calculator” from AMarkets. Source: AMarkets’ Traders Calculator.

Select a desirable financial instrument (in the chart above, we took EUR/USD as an example), lot size, leverage and account currency. The calculator will calculate the trading conditions automatically and display them for each account type.

Don’t put off your trading until tomorrow – use professional trading tools now.

Stage 3. Insight

Having tested various trading strategies and gained experience, the trader realizes that using complex analytical approaches may not guarantee financial stability.

Moreover, he discovers more and more examples of how experienced traders using even the simplest strategies based on trend channel trading or the intersection of two moving averages generate consistent profits.

Looking for the reasons why he can’t make a stable income from trading, the trader discovers two golden rules of trading – money and time management.

When a trader stops gambling and opening ambiguous high-risk positions and starts treating trading as a professional activity, he takes his trading to the next level.

Stage 4. Conscious competence

A trader makes consistent profits, conducting thorough market analysis and assessing each transaction. He gains an entirely new experience and increases his trading performance when he starts using proper money management.

Many professional traders automate their trading to save time and increase the efficiency of their trading. Using Expert Advisors (trading robots) )allows them to open positions and make money without spending hours at their trading desks.

AMarkets’ Expert Advisors and their performance. Source: AMarkets’ Expert Advisors.

One of the key differences between automated (algorithmic) trading and manual trading is that emotional factors are completely removed from trading decisions. A trading robot is software that uses a specific set of instructions to place a trade set by the trader. Positions are opened only when certain market conditions are met.

Try free trading robots and automate your trading now. Go to the “Expert Advisors” section and earn like a pro! Test and optimize your strategies with the Strategy Tester in MT4 and MT5 trading platforms and choose the most effective ones.

Stage 5. Unconscious Competence

The trader’s professionalism reaches its climax – he keeps making a steady income, but he can now quickly identify good trading opportunities without meticulous analysis. The trader gets the feel of the market’s pulse. It is often enough for him to look at the price chart and indicators he uses to determine the market entry and exit points.

Earn like professional traders now! Subscribe to the AMarkets Telegram channel and follow daily trading ideas from recognized market experts.

Top 3 rules for successful trading

Each trader passes through these stages as he accumulates the necessary experience and trading skills. However, there are several rules that will help every trader go through this process faster and more confidently.

Rule #1: Optimize your trading system

Every professional trader has a solid trading strategy that allows him to make trading decisions based on specific signals. The number and nature of these signals may differ depending on the trading style and the selected timeframe.

Most trading strategies involve taking a position only when several signals appear. For example, before opening a BUY order, a trader receives the following signals:

- the market is oversold;

- the uptrend is about to begin;

- a fractal, signaling the culmination of a downtrend appeared (fractals are used to identify reversal points in the market);

- other signals.

When building a trading system, it is important to optimize it in two directions:

- Conditions for opening and closing trades. In other words, a trading strategy. Let’s take a simple trading strategy as an example. A trader decides to open and close trades based on moving averages: if the “short” moving average (Moving Average, MA) falls below the “long” MA on the price chart, then a SELL trade is placed and a BUY trade is closed, and vice versa. In this case, the “short” MA means the moving average that has a shorter period than the “long” one.

If a trader is not sure which period it’s better to set for each MA, he can use the “Strategy Optimization” function pre-installed in the MT4 and MT5 trading terminals in the “Strategy Tester” section. It allows the trader to test and optimize a strategy using historical data and get results for each set of periods for MA. This way, he can choose the best-performing ones and test them in live trading.

- Money management strategy. Many professional traders agree that this aspect is even more important than the trading strategy itself. There are different approaches to money management. For example, keeping the 2:1 Profit/Loss ratio in each transaction. CNN‘s business analysts offer a simple but often overlooked piece of advice to novice traders: don’t risk more than you can afford.

Use one of the most effective tools to analyze your trading strategy: AMarkets’ Trade Analyzer. Get advanced detailed statistics on your trading strategy and practical recommendations on how to improve it.

Rule #2: Use a quality trading platform

Trading platforms with a user-friendly interface and a wide range of functions allow professional traders to save time on market analysis.

Let’s consider the main parameters of trading platforms that have a convenient interface and help traders quickly and efficiently analyze the price action.

MetaTrader 5 trading platform interface. Quotes are provided by the AMarkets online broker. This information should not be construed as investment advice.

The screenshot above shows the interface of the MT5 trading platform and different graphical representations of price charts and indicators.

A convenient trading platform should include the following features:

- a wide range of financial instruments. It’s a great way to diversify your trading;

- a large number of indicators, which allow you to analyze a selected asset from different angles;

- a built-in economic calendar to analyze the market events without the need to switch to external websites;

- the ability to customize charts according to your preferences;

- algorithmic trading – the ability to use ready-made trading robots or create your own using an internal programming language.

The MetaTrader 5 is a top-quality and powerful trading platform that has all these features.

Rule #3: Stay cool and calm while trading

Emotions can prevent you from making rational decisions and following your strategy. One of the main rules of professional traders is: keep your head cool while trading.

Fortune analysts note that it’s important to understand which emotions drive you specifically while trading. Fear or greed can overwhelm our judgment, causing us to make irrational decisions. An experienced trader gets into a trade with a well-defined plan, ready for both large profits and losses consistent with his trading style and money management strategy. Most importantly, a professional trader focuses on the opportunities the market offers, not on the money made or lost.

Why? Because he knows that excellent trading opportunities appear on the market all the time. So, even if he misses some of them, the new ones will soon present themselves.