The market is at major crossroads. On the one hand, recent macroeconomic statistics from the Eurozone and the United States indicate global economic recovery. On the other hand, more COVID-19 cases reported in the US may be a sign that the country is heading for the new wave of the pandemic.

So, the number of confirmed coronavirus cases in the United States is growing every day, recording the highs. Texas, California and Florida are named among the most affected states. These are not only the country’s industrial centers, these are the US leading states in terms of gasoline consumption. And this news may be considered as a signal that the US GDP isn’t going to recover any time soon.

Growing tensions between the US and China and India and China add fuel to the fire amid the continuing coronavirus spread, which also affects international trade. The Global Times, an English-language Chinese newspaper accused New Delhi of conspiring with Washington and stated that China was ready for war on two fronts – both on the border with India and in the South China Sea. In addition to this brewing conflict, the US and China are bickering over the situation around Hong Kong again. All this news keeps risky assets and currencies under pressure.

This upcoming week is rich in economic events, both from Europe and from the US. The US labor market report for the past month is likely to become the most significant release. The publication of the labor market data was moved to Thursday due to the national holiday in the United States. All in all, the market is expected to be rather volatile this week, investors are now looking for potential drivers and triggers.

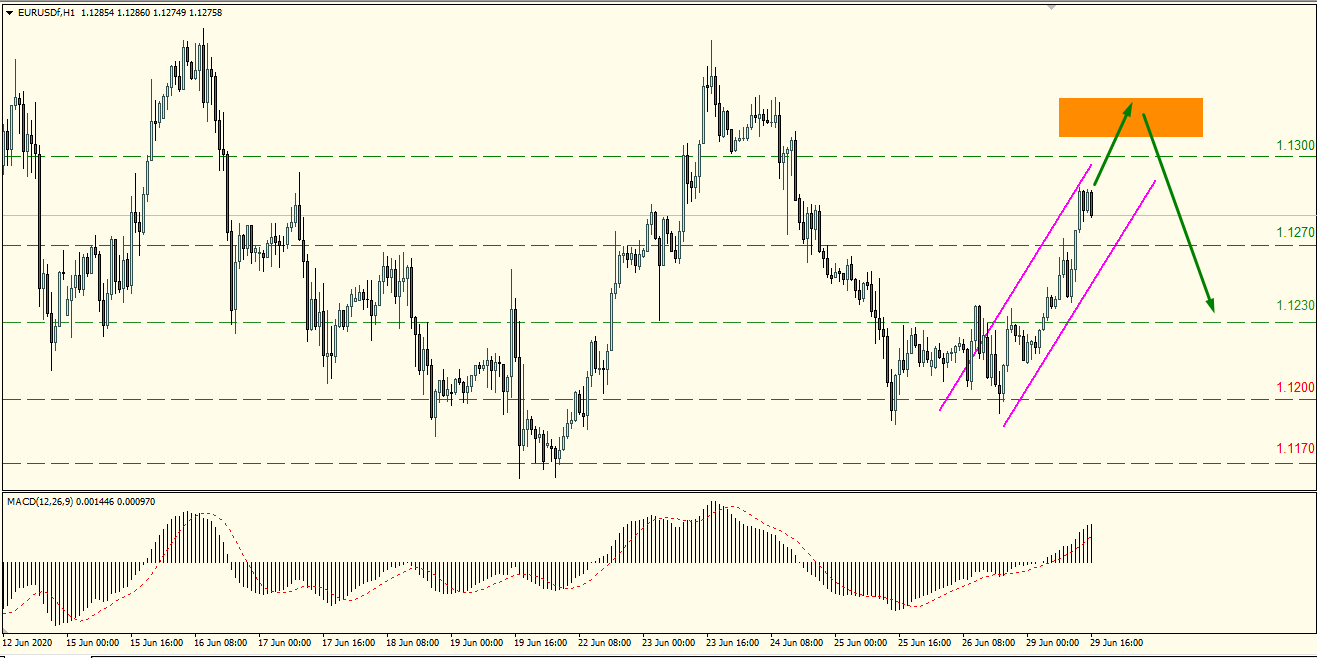

We believe that major market players on the stock exchange are now including the medium-term strengthening of the US dollar into their projections. Today’s growth of the EUR/USD pair was nothing but a well-planned maneuver to attract buyers. Its main purpose is to push the price higher in order to dump it lower shortly afterwards. The reversal, in our opinion, will most likely occur somewhere within the 1.1300-1.1370 range. That’s where we recommend you to go short.

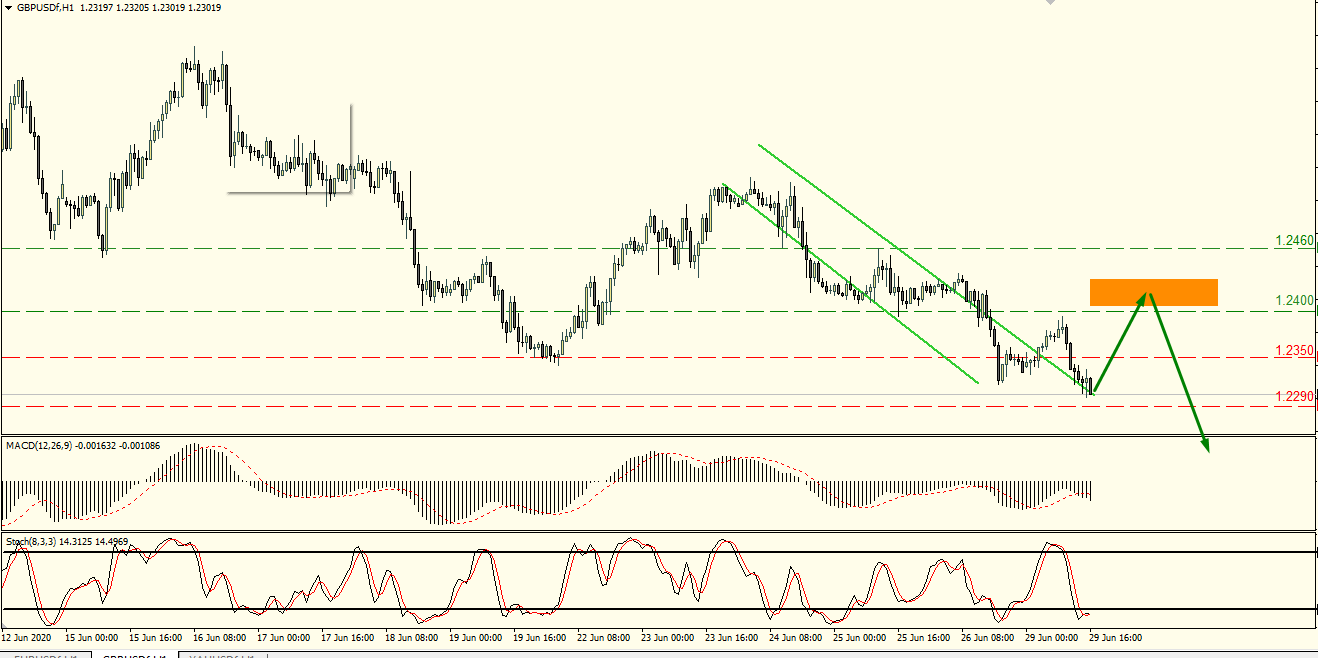

The pound also remains under pressure. The unresolved Brexit issue is producing a negative impact on the British currency, hindering its potential growth. The GBP/USD pair is currently trading at 1.2300-1.2320. It looks like the price is getting ready for a rebound and a subsequent breakout above this area. The bounce up may continue to the resistance area of 1.2400-1.2430. After that, the pair will probably resume its downtrend.

To stay up to date with all major events, subscribe to our Telegram channel.